Aba Business Financial Projection Excel is a unique tool for every company that desires to have financial insight. It is know that many companies do not have good forecasting skills. They can lose great opportunities and make wrong costly decisions.

That is why forecasting is critical as it provides a road map. Decisions can be based on rather than guessing at the future of the business. Aba Business Financial Projection Excel combines to offer a solution. Excel-base tool that is use to design comprehensive financial projections.

It also helps businesses to comprehend various conditions involving the use of KPIs. Performance level of a business and come up with mechanisms for solving problems. It provides the best picture of the future financial prospects of a certain company. It includes income statements, balance sheets, and cash flow.

Thus, professional and user-friendly, Aba Business Financial Projection Excel helps businesses. To prepare for monetary changes and plan well for their future.

Getting Start with Aba Business Financial Projection Excel

Accessing Aba Business Financial Projection Excel is simple. First, ensure your system meets the requirements. Most modern computers are compatible. The tool works with recent versions of Microsoft Excel. Follow the step-by-step guide to set up the tool correctly. This process includes opening the file and enabling necessary features. Proper setup ensures accurate financial projections for your business.

Downloading and Installing

Find Aba Business Financial Projection Excel on the official website. Look for the download button. Click it to start the download. Once complete, locate the file on your computer. Double-click to open it in Excel. No separate installation is need. The tool runs directly in Excel. Save the file in a location you can easily find later.

Navigating the Interface

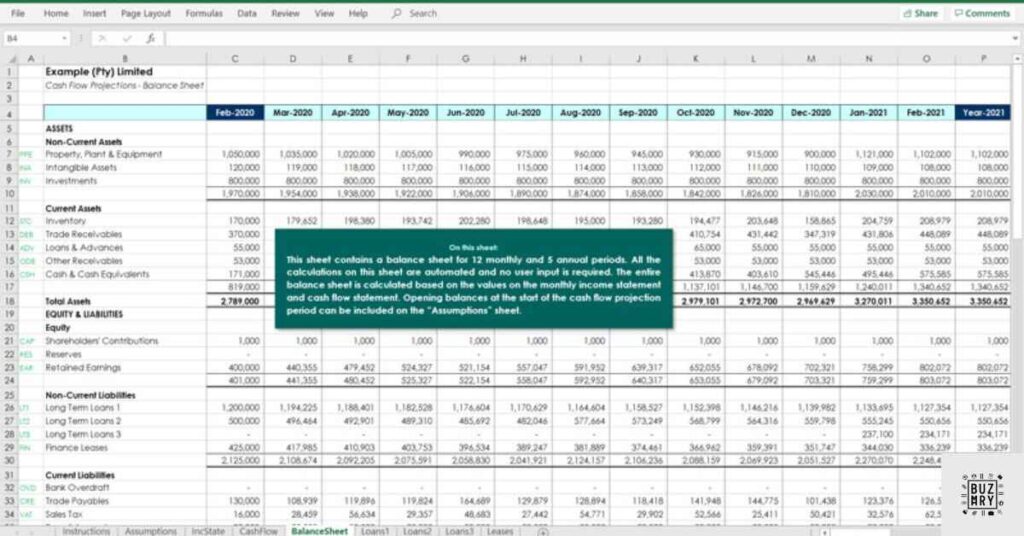

The Aba Business Financial Projection Excel interface is user-friendly. The main worksheet shows different tabs at the bottom. Each tab represents a key section of your financial projection. Look for tabs like Income Statement, Balance Sheet, and Cash Flow. The top of the sheet contains input cells for your data. Familiarize yourself with these sections to use the tool effectively.

Core Components of Aba Business Financial Projection Excel

Aba Business Financial Projection Excel has several main sections. These include the Income Statement, Balance Sheet, and Cash Flow projections. Each section focuses on a different aspect of your business finances. They work together to create a complete financial picture. Understanding how these components interact is crucial for accurate projections. The tool combines data from all sections for comprehensive analysis.

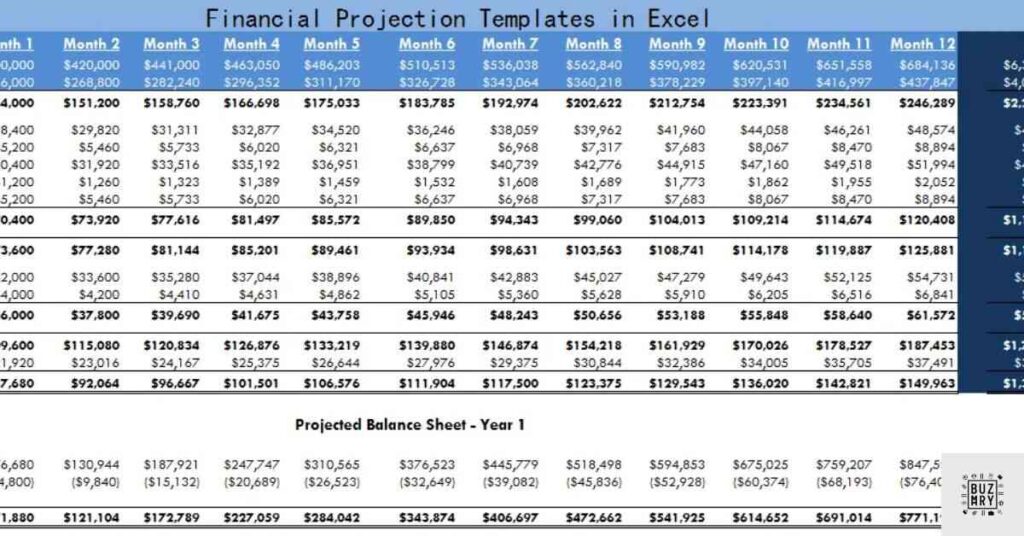

Income Statement Projections

To project revenue in Aba Business Financial Projection Excel, input your sales forecasts. Break down revenue by product or service. For expenses, enter costs like salaries, rent, and marketing. The tool calculates gross profit automatically. It also projects your net income. Review these projections regularly to ensure accuracy. Adjust inputs as your business situation changes.

Balance Sheet Projections

In the Balance Sheet section, input your current assets and liabilities. The tool helps project future values based on your inputs. Enter expected changes in inventory, accounts receivable, and debts. Aba Business Financial Projection Excel calculates your projected equity automatically. This forecast helps you understand your future financial position. Use it to plan for growth or identify potential issues.

Cash Flow Projections

For cash flow projections, begin with the amount of money that you have in your pocket to begin with. Record the expected cash receipts from the core activities such as the sale of products and services. The following input cash receipts from external sources are expect to be receive in the future for expenses and investments.

Aba Business Financial Projection Excel determines your forecasted cash balance. This forecast is important as it assists you in avoiding a situation where you end up having no cash. It also helps to demarcate times when you might have idle funds that you can employ.

Aba Business Financial Projection Excel :

Aba Business Financial Projection Excel comes with some of the most attractive features. That makes it go past the basic financial projections. Some of them are for seeing more specific cash flow analysis. Most years of forecasting, and even more advanced financial modeling.

It is also possible to modify given templates according to the various requirements. Business to achieve authentic and applicable estimations. They enable a business to drill down into greater details thus providing them. A better understanding of their financial situation for efficient planning for the future.

How to Leverage These Features for In-Depth Analysis

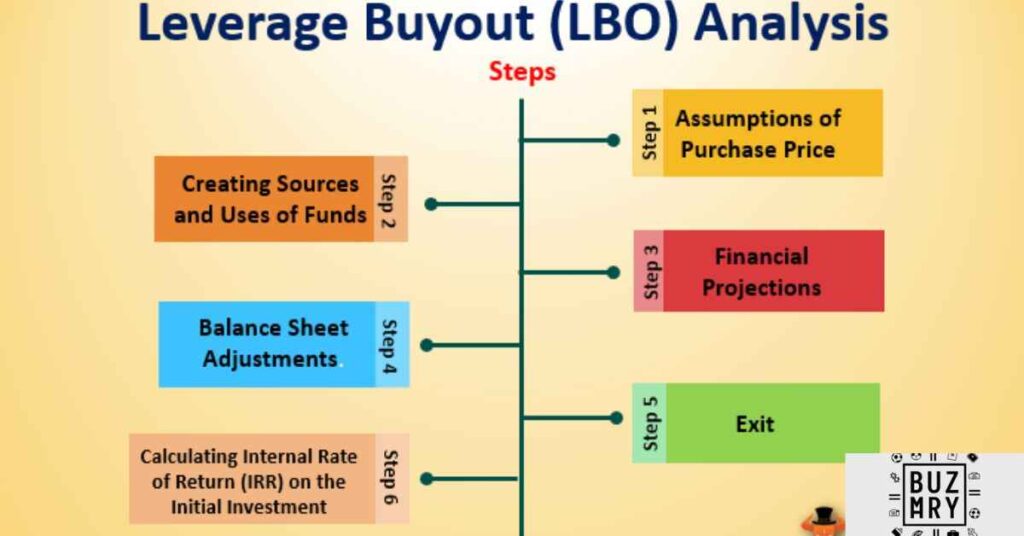

To get the most out of Aba Business Financial Projection Excel. Start by exploring its advanced tools like scenario analysis, sensitivity analysis, and break-even calculations. These features allow you to test different financial outcomes and understand the potential risks and opportunities.

By leveraging these tools, you can create more robust financial models that provide valuable insights into your business’s future. More information on the creation and comparison of financial conditions is provided by the scenario analysis in the Aba Business Financial Projection Excel.

For instance, you can predict various outcomes such as if it happens as expected or at worst or even at best how they would affect your business in the light of changes in revenues, cost, or market conditions. These serve to mitigate risks and thus facilitate the formulation of less vulnerable approaches.

Guidelines for using ‘Scenarios’

When it comes to scenario analysis, first of all, define are crucial factors that influence your business. Make realistic assumptions for each case and review them from time to time.

It is also very useful to restrict the number of scenarios because this reduces the complexity of the decision analysis. In this way, the attempted strategies discussed below will allow you to have a better understanding of the possible future scenarios and be ready for them.

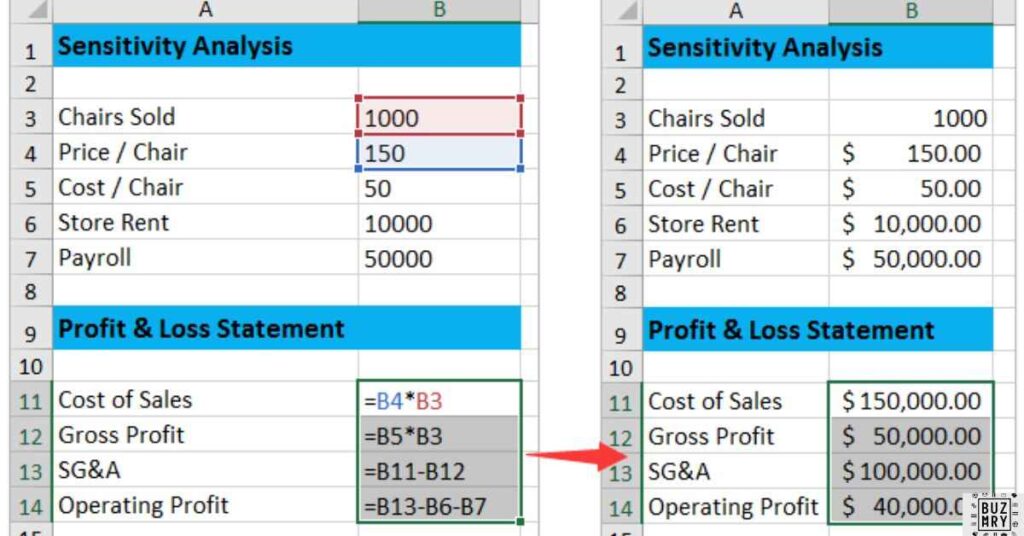

Sensitivity Analysis

Using the Aba Business Financial Projection Excel tool, Sensitivity analysis makes it easy for a company to realize the impacts that certain changes have on the business. Using these options, one can learn the major and minor changes in a business and find out which of them have strong influences.

Procedure of how to do Sensitively analysis for Excel Tool

Sensitivity analysis can be initiate as follows: Identify the variables that are to be independent and dependent. Remember that there are correcting tools in Aba Excel, use these tools to alter these variables and notice the outcomes of the changes on the options that you have chosen. This may assist in targeting those which are most at risk give the changes in inputs and therefore some degree of attention can be direct toward managing such risks.

Break-Even Analysis

This aspect of Aba Business Financial Projection Excel makes it easy for an individual to know the chances that the business has of being in a position to make profits or rather incur losses this, is give the point where the costs are equal to the income thus know as the break-even point.

Scenario Analysis

More information on the creation and comparison of financial conditions is provided by the scenario analysis in the Aba Business Financial Projection Excel. For instance, you can predict various outcomes such as if it happens as expected or at worst or even at best how they would affect your business in the light of changes in revenues, cost, or market conditions. These serve to mitigate risks and thus facilitate the formulation of less vulnerable approaches.

Guidelines for using ‘Scenarios’

When it comes to scenario analysis, first of all, define what are crucial factors that influence your business. Make realistic assumptions for each case and review them from time to time.

It is also very useful to restrict the number of scenarios because this reduces the complexity of the decision analysis. In this way, the attempted strategies to be discussed below will allow you to have a better understanding of the possible future scenarios and be ready for them.

Sensitivity Analysis

Using the Aba Business Financial Projection Excel tool, Sensitivity analysis makes it easy for a company to realize the impacts that certain changes have on the business. Using these options, one can learn the major and minor changes in a business and find out which of them have strong influences.

Procedure of how to do Sensitively analysis for Excel Tool

Sensitivity analysis can initiate as follows: Identify the variables that are to be independent and dependent. Remember that there are correcting tools in Aba Excel, use these tools to alter these variables and notice the outcomes of the changes on the options that you have chosen. This may assist in targeting those which are most at risk give the changes in inputs and therefore some degree of attention can direct toward managing such risks.

Break-Even Analysis

This aspect of Aba Business Financial Projection Excel makes it easy for an individual to know the chances that the business has of being in a position to make profits or rather incur losses this is give the point where the costs are equal to the income thus know as the break-even point.

Issues to Consider in Break-Even Analysis

Following is the information that may use after determining the break-even point to make vital business decisions: For example, with help of the SWOT analysis you may establish whether the pricing strategy is feasible or whether you should decrease the cost.

Knowledge of the break-even point assists in goals and objectives especially in the volume of sales to undertake in order to generate the required revenues to cover the fixed and variable costs as well as contribute to the development of good business strategies in an attempt to attain profitability.

Customizing Aba Business Financial Projection Excel

To make it work for your own Aba business, there is need for you to customize the Aba Business Financial Projection Excel. First, work on templates, adapting them to the field and individual financial needs concerning the company’s operation. It can augmente or diminishe, modifi equations, and they even include your logo. In this way, the tool is tune to reflect your specific business model and assists in achieving better accuracy of predict sales.

This is important because one business is unique from the other hence needs to sign up separately. This strategy does not always fit into the diverse operations existing out there since not all business operations are similar. In this way, you implement the Excel tool of higher efficiency and adjust it to your specific company’s needs. This results in improved decision-making and the overall awareness of the financial conditions to come.

Adding Custom Formulas

Business owners can modify the formulas that apply to the excel financial model in Aba Business Financial Projection Excel to suit their business’s arithmetical computations. For instance, if your business requires the formulation of costs or revenue, there you can come up with formulas depending on your business. This leads to development of accurate and more specific precision of the financial forecast.

Creating Custom Reports

They include; Aba Business Financial Projection Excel enables you to develop your own reports depending on the needs of your business. You give the freedom of which data to use select, orientation, and even enhance with mere visuals like graphs.

This eliminates a general message that most often is contradicting and instead makes communication of your financial status easier.In detail, I would like to stress that while preparing C-suit and managerial specific reports, appeal to the main three Cs: Cut, Clarity, and Relevance.

Make sure that the information is easily understandable and it is present both in word and picture forms that are easy to manage. Synchronize it in a meaningful and easily understandable manner and ensure that key points are easily accessible. This means that there is a quality check on your reports besides articulation that makes them readable and coherent.

Data Input and Management

This is very important since data entry is the key determinant of the reliability of the forecasted financial statements. First of all, to begin with, ensure that you have all the information that you are to input on Aba Business Financial Projection Excel. Revisit input data for verifications and check for compliance to the required format. This data should update frequently so as to ensure that the projections are up to date.

To make the right strategic and managerial decisions data accuracy is therefore very important. Inaccurate/out-of-date data can hence result in wrong prognoses and wrong strategic decisions. The accuracy of your forecast is improve when you ensure that your data is accurate and also contemporary data is use in the financial forecasting process.

Data Sources and Collection

Choosing reliable data sources is key to accurate financial projections. Use internal records, market research, and industry reports as primary sources. Ensure that the data is up-to-date and relevant to your business model. Reliable sources lead to trustworthy financial insights.

Efficient data gathering involves setting up systematic processes. Use spreadsheets to organize data, automate data collection where possible, and regularly review sources for relevance. This helps streamline the process and ensures that you’re working with the best information available.

Data Validation and Error Checking

They offer the user a range of data validation functions that would minimize the possibility of inputting the wrong parameter. These features can notify you about gaps in records or about the fact that some of them were enter in the wrong style. Applying these tools guarantees that only quality data form the basis of your financial forecasts.

Mistakes that analysts make while preparing financial projections and forecast include wrong equations, wrong figures, and wrong data. You should therefore conduct a periodic check on your Excel sheets for these problems. Take advantage of tools like spell checker and other related tools to ensure you do not make mistakes and rectify them as soon as possible to avoid compromising on the accuracy of the projection.

Result Analysis and Decision Making

After you have written your data into Aba Business Financial Projection Excel let the results be analyze. Check on the numbers such as revenue, cost and being expect to earn a profit. This keeps changing and you need to compare these with your business goals so that you can know if you are head in the right direction. Concentration shell be make on trends and patterns in a bid to analyze the financial position of the business. They will help you in your future planning of the business’ strategies and operations.

Business strategy making: the use of projections

The financial forecasts that you create may well become potent weapons that can be use in defining your strategy. Give them to you so you can point out where you and your company could save money, make more money or grow.

Having projections can really assist one in preventing possible hitches and planning for succeeding prospects. Organizing your actions with these beliefs at heart is positive because you and your strategy will then be in sync with the tips list above.

Key Performance Indicators (KPIs)

KPIs can describe as business measurements that help in evaluating your business’s financial status. Typically, KPIs may be profit margins, cash flows, and return on investments, among others. The right KPIs will lead you to focus on the things that should be accomplish. Aba Business Financial Projection Excel can monitor those indicators so that you always have a clear picture of how your business is faring.

How to Set Up KPI Tracking in the Excel Tool

To track KPIs in Aba Excel, start by identifying the metrics most relevant to your business. Set up separate sections or tabs in the Excel tool for each KPI. Use formulas to automatically calculate these metrics from your financial data. Regularly update the data to ensure your KPIs reflect current performance.

Decision-Making Framework

Business forecasts are important in its strategic planning and management, especially in financial planning. Whether one is planning on making a fresh investment or deciding on the extension of business or alteration of prices, projections are factual underpinnings of the decisions take. They help you evaluate the pros and cons of each endeavor so that you do not make wrong choices most of the time.

Make Successful Decisions

Decision-makers who employ the help of Aba Business Financial Projection Excel most of the time obtain improved results putting emphasis on prognoses. For instance, it can use by a small business where to invest, for instance, in a new product line. It helps the business to take a definite decision with the help of anticipated sale and cost instead of guessing.

Aba Business Financial Projection Excel

To make the best use of Aba Business Financial Projection Excel, ensure you record and update the information that goes into the excel at all times. Make sure you go through your projections by intervals and make essential changes where necessary. All the features like the scenario analysis and sensitivity analysis can then use in order to find out the various possible results. This prevents throwing unrealistic and utterly useless numbers at a given problem; which should help in obtaining the best estimates.

Common Pitfalls to Avoid

Don’t make mistakes you input wrong data or information which maybe are out of date. They don’t have to utilize in their conventional form – there is so much benefit in customization for the particular tasks at hand. Another drawback of the model is a consistent failure to update projections on daily basis, what distorts final outcome. Be alert so that no factors distort the flow of your financial estimates.

Regular Updates and Revisions

Of course, any financial projections are based on information that is available today and thus only have the accuracy of today’s information. It is important to ensure that all the data held in them are put to date so as to produce accurate forecasts. Updates shell be done in every financial period so that your projections shell correspond with current business conditions and enable you to determine whether you are on track. This practice is crucial in decision-makings and evoking decisions on time.

Read This Blog: Rebekka Thor Thor Marketing: Elevating Your Business To New Heights

The following outlines the general guidelines of how frequently one should update financial projections:

Of course, you should update your financial projections monthly or at least on a quarterly basis. Yet, it can make more frequently if your business is growing fast or experiencing major changes. A strategy that has to change relatively often must still change often enough so that it can react to new developments without compromising financial goals.

Collaboration and Version Control

That is why coordination is a critical factor if many people are involved in creating financial estimates. Save the Aba Business Financial Projection Excel in a place accessible by the team, that is in the cloud such as through Google Drive or One Drive. Thus, define who is allowed access to the file and how the changes should be made and documented. This approach makes sure that everyone is in harmony especially where decisions have been made.

Managing Multiple Versions of Projections

Version control is crucial to prevent confusion and errors. Always save a new version of the file when making significant changes. Label each version clearly with the date and a brief description of what was updated. This practice helps you track changes over time and ensures that the latest version is always available.

Integration with Other Business Tools

Aba Business Financial Projection Excel is also compatible with other business tools so it makes the business planning and analysis more effective. For instance, you can integrate it with QuickBooks or Xero accounting tools so as to have a broad perspective of your financial position. It assists you in tracking and managing your financial data in the easiest way possible so that each piece of data is compatible with the other.

Also Read This Blog : Industrial Marketing Challenges: Best Practices for 2024

Improving Corporate Strategy and Analysis Across The Firm

Whenever you combine Aba Excel with other tools you will be able to enhance your business planning and analysis. For instance, you can enhance your sales forecast by importing sales data from a CRM program. Ideally, this approach makes sure that your business decisions incorporate all available data that you need for the decision-making process.

Exporting data to other rather unique blogging and social platforms

It is easy to export data used in Aba Business Financial Projection Excel in other programs and applications. In Excel, you can export your files as CSV or XML files which are compatible with most of the required business applications. This makes it possible to integrate the financial projections into other software for managing data such as accountancy, and customer relationship manager among others.

Compatible Software and Integration Options

By integrating Aba Excel with many other common business tools, activities become easy to run. Using it is possible to integrate it with accounts software such as QuickBooks, Xero as well as Microsoft Power BI. These integrations make it possible for you to transfer data from one platform to the other more efficiently which helps you to achieve much accuracy and efficiency when you are handling your finances.

Delivering Data from Other Sources

It is possible to use Aba Business Financial Projection Excel to incorporate data from other sources for improved financial prediction results. For instance, replenishing your sales data from a Customer Relation Management system or financial data from the accounting software can help to increase the accuracy of your projections. It is recommended to import this information with the help of Excel’s tools for data import.

Automating Data Import Processes

By this, a lot of time and effort is saved as well as the chances of making mistakes are reduced, it is advisable to automate the importation of your data. It is possible to incorporate Excel with other business systems using Excel’s built-in features or plugins to help in data feeds. This automation makes it possible to work based on the most current data in order not to make a mistake when entering it manually.

Troubleshooting Common Issues

Some of the problems that users face when using the Aba Business Financial Projection Excel are Formula errors; Slow running of the program or application; and Data entry errors among others. If there are some calculation errors coded with formulae, please make sure that the corresponding cells and their references are correct.

If your working file is slow, then it’s best to preprocess your data and minimize the usage of formulas. It is possible to enhance data availability to avoid loss arising from accidental deletion of data or file corruption through regularly backing up data.

Resources for Additional Support

Several sources can be utilized if you experience problems you cannot handle alone. The official Excel help center provides articles and How-to articles. Whereas, reddit or stack overflow may be good places to find communities to support the same. For more detailed issues you are advised to contact a consultant specialized in Excel or take advantage of customer services assisting with the software.

Formula Errors and Fixes

Some of the most frequent formula errors that are associated with the Aba Business Financial Projection Excel include #DIV/0!. , #VALUE! , and #REF!. The #DIV/0! This is an error that happens when for instance a formula is about to divide and there is zero in the denominator.

The #VALUE! error is used if there is an issue with the type of data entered in a cell while the #REF! the error occurs when there is a use of a formula and that formula points at a cell that is non-existent. Such mistakes can bring distortions in your financial planning and control if not rectified.

Step-by-Step Troubleshooting Guides

To fix the #DIV/0! error, look at the divisor in the formula you used while conducting calculations and be sure it is not zero or blank. For #VALUE! mistakes, make sure that all the references to a cell include the right type of data. To resolve a #REF! in the case of an error, be certain that all the formulas used shall point towards genuine cells. Sometimes when using Excel, you may by mistake delete a cell, which means you would have to rewrite your formulas to make them point to the right data range.

Performance Optimization

If your Aba Business Financial Projection Excel file is slow here are several factors that you can use to address the problem. Reduce the complexity of the formulas, switch Excel to the “Manual Calculation” option, and try not to use such functions as INDIRECT or OFFSET too often. Removing unrequired rows, columns in your data, or unrequired worksheets also helps in improving the data processing speed.

Handling Large Datasets Efficiently

However, when handling large data sets, it is seen that Excel’s performance becomes a problem or the software becomes cumbersome to use. To deal with these effectively, make your data more manageable and categorize it into workable subdirectories.

One of the ways with which you can copy several records and summarize them without having to process all of it at once is by using PivotTables. Another feature that can be achieved by using a PC is the ability to manipulate large volumes of data rather than it within the Excel table which contributes to an increase in speed.

Future Developments and Updates

Some of the future advancements that may be seen in Aba Business Financial Projection Excel can include more effective graphical presentations of data, better templates, and more effective compatibility with other business software programs. Such updates could enhance the tool’s capabilities and the time taken to develop sound forecasts by reducing it further.

How to get aware of new features or new versions?

To be certain that you are using the latest version of Aba Business Financial Projection Excel, you should read newsletters, or visit the company’s website. Most software firms also have social media platforms that they use for making announcements. One can also read articles from user communities or forums where the professionals share about new developments and how to optimally use them.

Conclusion

Specifically, Aba Business Financial Projection Excel is useful to any business that wants to plan its financial planning well. With it, one can foresee some obstacles and capitalize on some gains. The use of this tool in the process of managing and constructing the financial statements.

To establish the right financial objectives to plan for in to ensure the success of the business. The software is simple to use and configurable with many features, it is suitable for any business and promotes the active supervision of the financial situation and the company’s effective development.

Frequently Asked Question

How accurate are financial projections made with Aba Business Financial Projection Excel?

Projections are as accurate as the data you input. Accurate data and assumptions lead to reliable forecasts.

Can Aba Business Financial Projection Excel be used for personal finance planning?

Yes, it can be adapted for personal finance. However, it is primarily designed for business use.

What’s the difference between Aba Business Financial Projection Excel and other financial modeling tools?

Aba Excel is user-friendly and customizable. Other tools might offer more complex features.

How often should I update my projections in Aba Business Financial Projection Excel?

Update projections at least quarterly. More frequent updates keep your data current.

Is Aba Business Financial Projection Excel suitable for startups and small businesses?

Yes, it is ideal for startups and small businesses. It is designed to be simple and effective for smaller operations.

Can multiple users collaborate on a single Aba Business Financial Projection Excel file?

Yes, multiple users can collaborate via cloud services. Ensure proper version control to manage changes.

What level of Excel proficiency is required to use Aba Business Financial Projection Excel effectively?

Basic to intermediate Excel skills are needed. The tool is designed to be accessible to most users.

How does Aba Business Financial Projection Excel handle currency conversions for international businesses?

Currency conversions can be manually set up. You can add exchange rates and multiple currency columns.

Are there industry-specific templates available in Aba Business Financial Projection Excel?

Yes, there are various industry-specific templates. These are tailored to different business needs.

Can Aba Business Financial Projection Excel integrate with accounting software like QuickBooks or Xero?

Direct integration may not be available. Data can be exported and imported between Aba Excel and these tools.

Mr. Harry is the author of the business category on buzsmarty.com. With a keen understanding of market trends, he provides practical insights to help readers navigate the business world. His writing is clear, concise, and focused on delivering actionable advice. Mr. Harry’s expertise makes complex topics accessible to everyone, empowering readers to achieve their business goals.